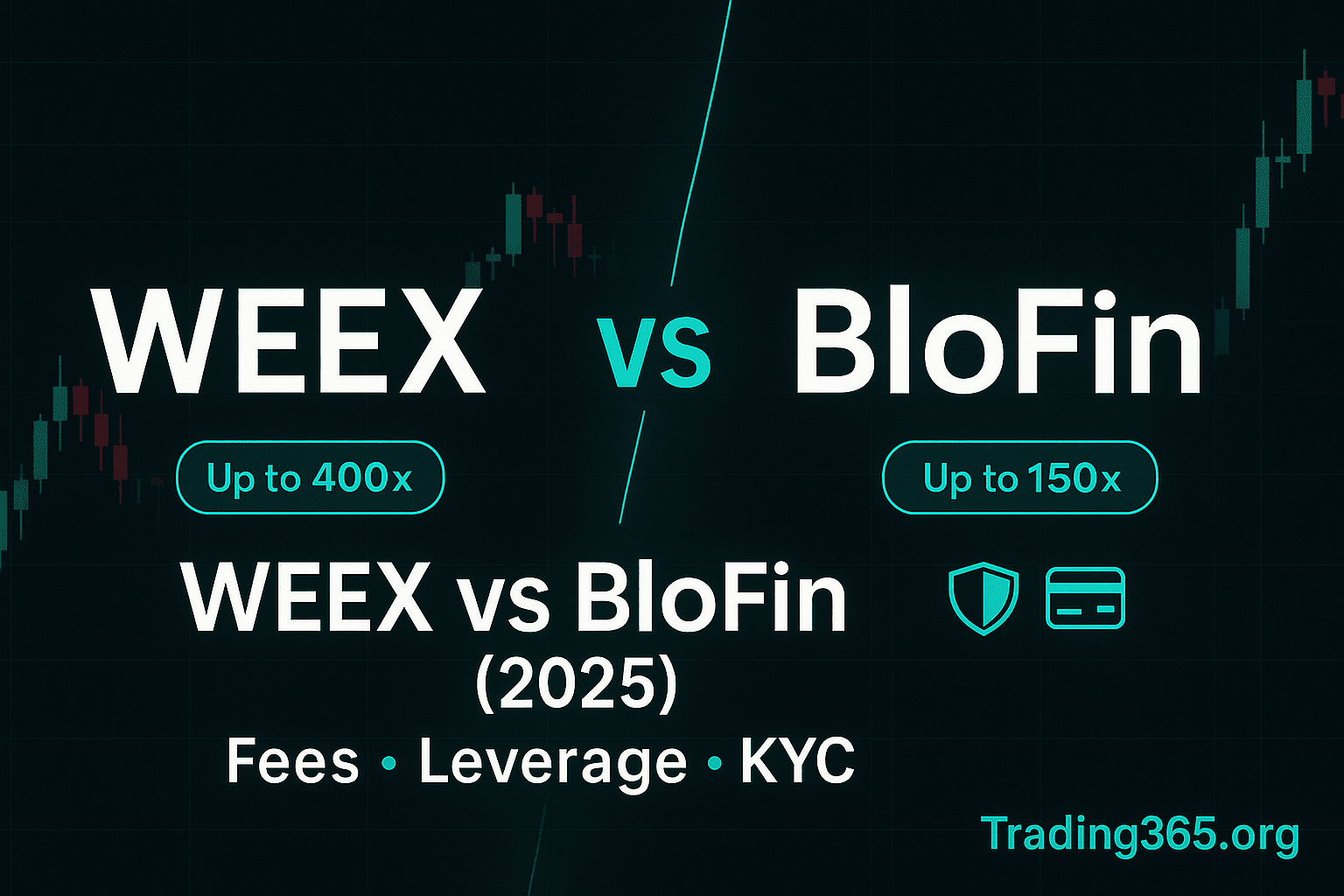

Now Reading: WEEX vs BloFin (2025): Fees, Leverage, KYC Limits, Cards & Copy Trading Compared

-

01

WEEX vs BloFin (2025): Fees, Leverage, KYC Limits, Cards & Copy Trading Compared

WEEX vs BloFin (2025): Fees, Leverage, KYC Limits, Cards & Copy Trading Compared

Quick Verdict

Choosing between WEEX vs BloFin actually impacts your bottom line and how you trade day to day. Their fees and VIP discounts shape your cost per trade, leverage ceilings change how big you can size positions, and KYC/withdrawal limits affect privacy and cash-out flexibility. Beyond that, the toolsets differ—WEEX leans into simple pricing and copy trading, while BloFin focuses on capital efficiency with a Unified Trading Account and automation/bots—and regional availability (like cards) isn’t identical. This comparison cuts through the marketing to show which platform better fits your goals in 2025.

- Choose WEEX if you want ultra-high leverage (up to 400×), straightforward fees (maker 0.02% / taker 0.08% on futures), and an exchange that pushes copy trading with a headline 1,000 BTC Protection Fund—good for traders who like aggressive leverage and simple, predictable costs.

- Choose BloFin if you want more capital-efficient margining via a Unified Trading Account (UTA), access to copy trading + bots, and EEA users who want a Mastercard crypto card (KYC required). Futures fees start at 0.02% / 0.06% with VIP discounts down to 0% / 0.035%. Max leverage on BTC/ETH is 150×.

👉 Trade on WEEX (Up to 400×): https://www.weex.com/en/

👉 Trade on BloFin (UTA + VIP Fees): https://partner.blofin.com/d/KIFSCrypto

Comparison at a Glance

| Feature | WEEX | BloFin |

|---|---|---|

| KYC needed to trade? | No (KYC not required to deposit/withdraw). | No (Basic Lv0 available). |

| Unverified 24h withdrawal limit | 10,000 USDT/day. | 20,000 USDT/day. |

| Futures fees (base) | Maker 0.02% / Taker 0.08%. | Maker 0.02% / Taker 0.06% (VIP tiers to 0% / 0.035%). |

| Max leverage | Up to 400× (tiered by position size). | Up to 150× on BTC & ETH. |

| Copy trading | Yes (dedicated copy hub). | Yes (copy trading + strategy Copy Bot). |

| Trading bots | — | Yes (Futures Grid, DCA, more). |

| Unified trading / margin | — | UTA (consolidated & multi-currency modes). |

| Card | — | BloFin Mastercard (EEA), KYC required. |

| Protection/insurance | 1,000 BTC Protection Fund. | — |

KYC & Withdrawal Limits

- WEEX: You can deposit and withdraw without KYC; unverified accounts are limited to 10,000 USDT per day. Consider verifying if you need higher limits.

- BloFin: Basic (Lv0) accounts (no KYC) can withdraw 20,000 USDT per 24h; Lv1 increases to 1,000,000 USDT, Lv2 to 2,000,000 USDT.

Compliance note: Both platforms restrict certain jurisdictions; always check your local rules before trading.

Fees & VIP Tiers (Futures)

- WEEX: Base 0.02% maker / 0.08% taker on futures, with up to 70% discounts via token/VIP promotions and occasional 0-fee campaigns on new pairs.

- BloFin: Base 0.02% maker / 0.06% taker; VIP tiers reduce to 0% maker / 0.035% taker at the top level.

If you’re a high-volume futures trader, BloFin’s VIP curve can undercut WEEX; otherwise, WEEX’s flat schedule is easy to reason about.

Leverage & Markets

- WEEX: Up to 400× leverage, subject to position tiers and size; leverage reduces as your position grows.

- BloFin: Up to 150× on BTC/ETH perps (tiered by size).

Features That Matter

- Copy Trading

- WEEX: Full copy trading portal oriented to “Elite Traders”.

- BloFin: Copy trading for followers and traders, plus Copy Bot for strategy-based copying.

- Unified Trading Account (UTA)

- BloFin’s UTA allows consolidated margin, spot+futures in one account, and optional multi-currency collateral (with equity prerequisites). Great for capital efficiency.

- Trading Bots

- BloFin provides Futures Grid, DCA, and bot aggregation tools.

- Cards & Fiat On-/Off-Ramps

- BloFin Card (EEA): Virtual card for EEA users (KYC required), issued in partnership with Mastercard; SEPA and card payments supported for buy-crypto.

- Protection/Insurance

- WEEX advertises a 1,000 BTC Protection Fund, in addition to proof-of-reserves pages.

Pros & Cons

WEEX — Pros

- Very high max leverage (up to 400×).

- Simple base fee schedule; frequent promos.

- Copy trading hub + stated 1,000 BTC protection fund.

WEEX — Cons

- Base taker fee (0.08%) is higher than BloFin’s base (0.06%).

- No native card or UTA-style cross-collateral features.

BloFin — Pros

- Lower base taker fee (0.06%) and aggressive VIP discounts (down to 0%/0.035%).

- UTA for capital efficiency; bots + copy trading ecosystem.

- EEA crypto card (KYC required) + SEPA support.

BloFin — Cons

- Max leverage tops out at 150× (lower than WEEX’s headline figure).

- Card availability is region-limited and requires KYC.

Who Should Use Which?

- Active day traders & degen leverage users: WEEX for the 400× ceiling and straightforward fees/promos.

- Capital-efficiency & automation-focused traders: BloFin for UTA margining, bots, and VIP fee curve; EEA users who want a crypto payment card.

New to privacy-friendly platforms? Start with our No-KYC Exchanges in 2025

Hunting for promos? See the Best Crypto Exchange Bonuses 2025

FAQs

Is KYC required on WEEX or BloFin?

No to trade crypto, yes if you want higher withdrawal limits (or the BloFin card). WEEX allows unverified withdrawals up to 10,000 USDT/day; BloFin Basic allows 20,000 USDT/24h.

What are the futures fees?

WEEX: 0.02% maker / 0.08% taker; BloFin: 0.02% maker / 0.06% taker, with VIP discounts down to 0% / 0.035%.

What’s the maximum leverage?

WEEX up to 400×; BloFin up to 150× on BTC/ETH perps.

Does either offer a crypto card?

BloFin: yes, Mastercard virtual card for EEA users (KYC required). WEEX: no card offering listed.