Now Reading: BlackRock is Still Buying Bitcoin: What Do They Know That We Don’t?

-

01

BlackRock is Still Buying Bitcoin: What Do They Know That We Don’t?

BlackRock is Still Buying Bitcoin: What Do They Know That We Don’t?

BlackRock has reportedly increased its share in the IBIT spot Bitcoin ETF, pushing holdings to $314 million. Why is BlackRock buying Bitcoin? Will BTCUSDT break $100,000?

A crypto wave is sweeping through the retail and corporate world. Yesterday, New Hampshire became the first state to enact Bitcoin reserve legislation. Strategy, formerly MicroStrategy, is actively buying Bitcoin, recently scooping up over $1 billion of the coin. Meanwhile, institutions are actively accumulating and scrambling for the digital gold in May 2025.

DISCOVER: 20+ Next Crypto to Explode in 2025

BlackRock Reportedly Increases Stake in IBIT

News that BlackRock, one of the world’s largest asset managers, is reportedly increasing its stake in IBIT, its flagship spot Bitcoin ETF, pushing holdings to $314 million, a 124% increase from November, is a massive sentiment boost for holders.

BlackRock increases its position in the iShares Bitcoin ETF by 124%, bringing its total holdings to $314 million. pic.twitter.com/VV0paTSRCi

— Trader T (@thepfund) May 6, 2025

This strategic allocation, likely to two of its model portfolios, the Target Allocation with Alternatives and the Target Allocation with Alternatives Tax-Aware portfolios, could encourage other firms to follow suit.

Even so, despite relentless buying and “endorsement” from major players, the Bitcoin price remains below $100,000, throttling capital flow to some of the best ICOs to invest in.

One question looms large: What does BlackRock know that the rest of us don’t? Why are they increasing their Bitcoin allocation instead of buying Ethereum or other coins that analysts consider among the best to buy in 2025?

DISCOVER: 11 Best Crypto Presales to Invest in May 2025 – Top Token Presale

The Bitcoin Bet: What Does BlackRock Know?

The rapid increase in exposure by BlackRock suggests a deliberate strategy. After all, their active pursuit of BTC exposure via spot Bitcoin ETFs is not new.

By September 2024, their Strategic Income Opportunities fund (BSIIX) added over 2 million shares of IBIT, bringing its total to 2.1 million shares. Meanwhile, the Strategic Global Bond fund (MAWIX) increased its IBIT holdings by 24,000 to 40,682 shares.

In a portfolio filing today with the SEC, BlackRock disclosed owning 2,140,095 shares of IBIT in its Strategic Income Opportunities Portfolio as of September 30, valued at $77.3 million.

That’s an increase from 88,000 shares previously reported as of June 30.

If you’ve been…

— MacroScope (@MacroScope17) November 26, 2024

In a note to investors, Michael Gates, a lead portfolio manager for the Target Allocation ETF model portfolio suite, revealed the rationale behind their support for Bitcoin–one of the best cryptos to consider buying in 2025.

Gates said they are adding a Bitcoin position, funded from equities, as an “additional alternative asset”, pointing to its fixed supply. Including the asset in their portfolio allows them to diversify sources of risk and return.

He further emphasized that they could HODL Bitcoin, as it provides “unique and additive sources of diversification” to portfolios.

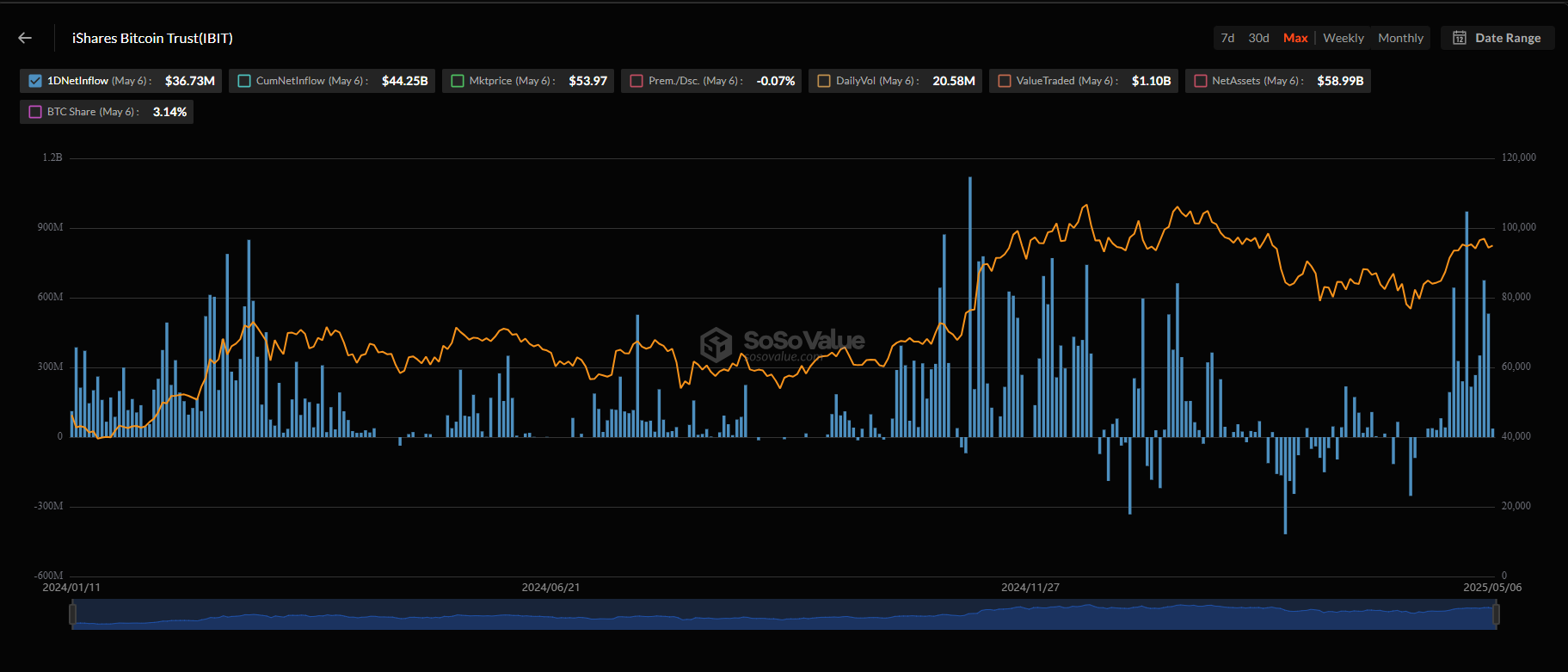

Institutions clearly see the value in holding Bitcoin. As of May 2026, IBIT managed over $58 billion from investors buying shares from BlackRock.

(Source)

In the past 24 hours, over $36 million in shares were purchased. IBIT ranks among the top five ETFs by inflows, trailing only the Vanguard S&P 500 ETF.

Why Is the BTCUSDT Price Stuck?

Despite steady inflows and aggressive buying from institutions, including Strategy, prices remain below $100,000.

Earlier today, prices rallied to as high as $97,700 before retracing from the resistance level.

(BTCUSDT)

On X, one analyst questions the ” supply ” source that keeps prices low.

You’re not allowed to ask where the Bitcoin “supply” is coming from.

BTC cleared $100k multiple times. Now for the last 2 weeks It’s stuck at $94k with M2 exploding, stocks up and gold up.$4 billion of ETF buys, $1 billion of Saylor buys.

But you’re not allowed to question it.— WhalePanda (@WhalePanda) May 6, 2025

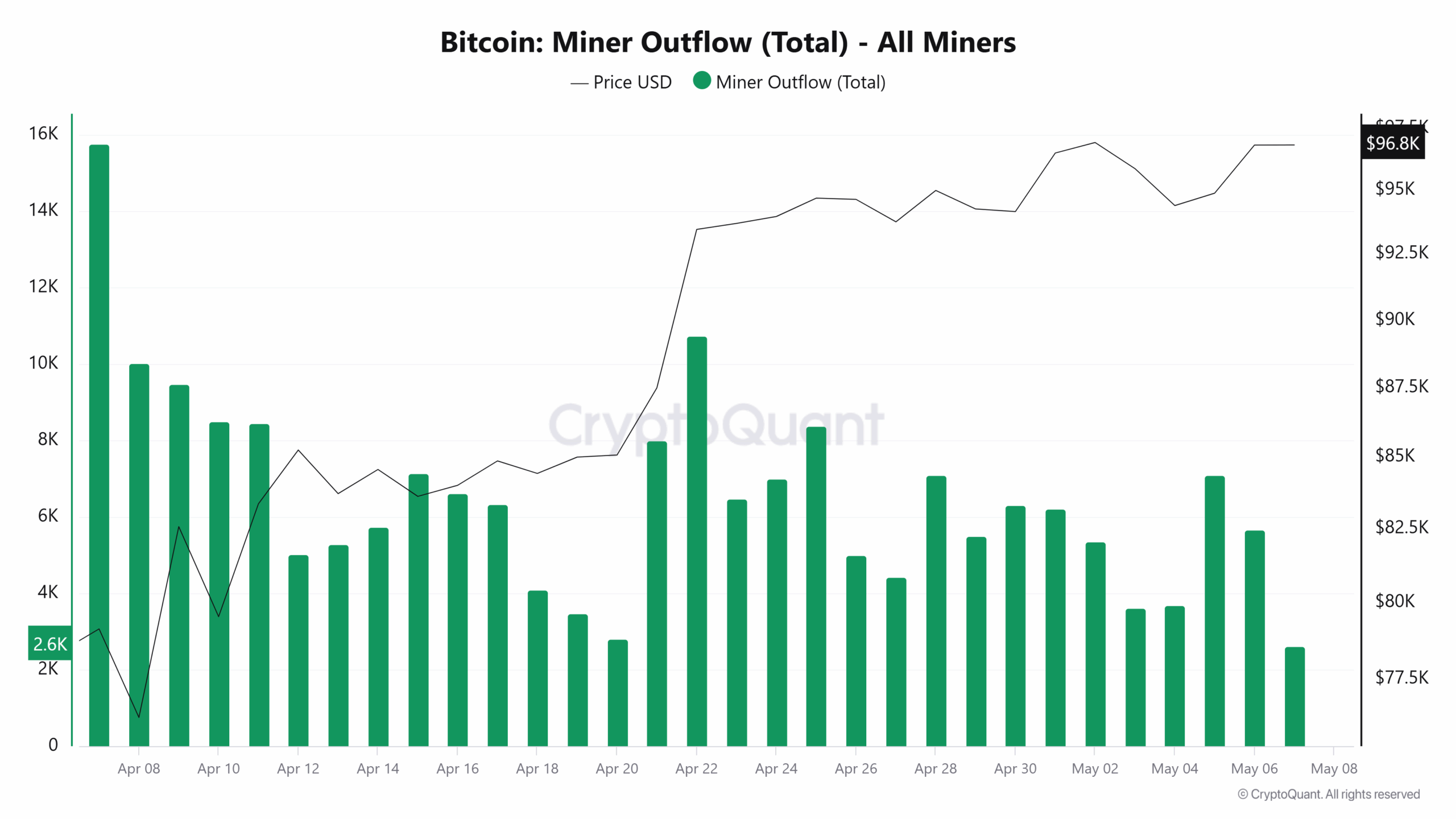

Bitcoin miners, who tend to sell when prices are high, have slowed their liquidation over the past month. According to CryptoQuant, only 5,678 BTC were sold on May 6, compared to 15,767 BTC sold on April 7.

(Source)

With miners holding and institutions buying, Bitcoin is likely to break above $100,000 in a buy trend continuation formation.

DISCOVER: Next 1000x Crypto – 12 Coins That Could 1000x in 2025

BlackRock Boosts Bitcoin ETF Stake: Why Is BTC Price Stuck Below $100K?

- BlackRock has reportedly increased its stake in IBIT, buying more shares

- Institutions are actively buying Bitcoin, following Strategy’s ways?

- Miners are not selling and HODL, as CryptoQuant trends show

- Why is the Bitcoin price stuck below $100,000?

The post BlackRock is Still Buying Bitcoin: What Do They Know That We Don’t? appeared first on 99Bitcoins.