Now Reading: What are the most popular Price Action Patterns And Their Percentage Of Success

-

01

What are the most popular Price Action Patterns And Their Percentage Of Success

What are the most popular Price Action Patterns And Their Percentage Of Success

Below is a brief overview of some popular chart patterns often used in technical analysis, along with approximate “success rates” based on historical backtesting (particularly from well-known sources like Thomas Bulkowski’s research). Keep in mind these are not guarantees—success rates vary by market conditions (bull/bear), asset class, time frame, and how strictly you define a “successful” breakout or price target.

1. Head & Shoulders (Top/Bottom)

- Overview:

- A “Head & Shoulders Top” forms after an uptrend, indicating a potential bearish reversal.

- A “Head & Shoulders Bottom” (Inverse Head & Shoulders) forms after a downtrend, indicating a potential bullish reversal.

- Approx. Success Rate:

- Head & Shoulders Top: 80–85%

- Inverse Head & Shoulders: 80–85%

These patterns are known for relatively high reliability when they confirm a breakout past the “neckline.”

2. Double Top / Double Bottom

- Overview:

- Double Top: Price tests a resistance level twice, suggesting a potential bearish reversal.

- Double Bottom: Price tests a support level twice, suggesting a potential bullish reversal.

- Approx. Success Rate:

- Double Top: 60–70%

- Double Bottom: 65–75%

Success rates often improve if the second “top” or “bottom” slightly undercuts/overshoots the first, confirming strong resistance or support.

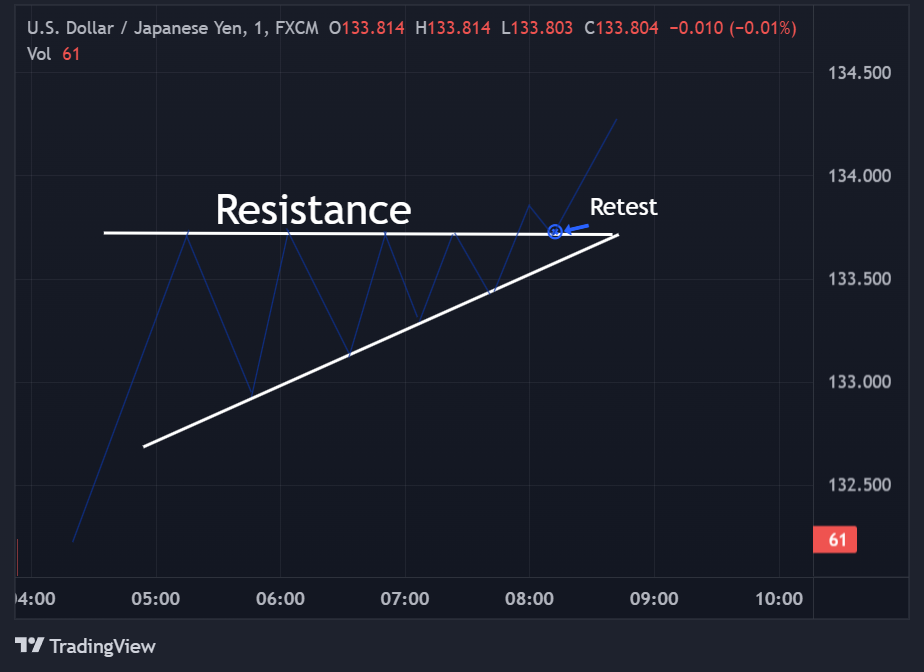

3. Triangles (Ascending, Descending, Symmetrical)

Ascending Triangle

- Overview: Typically a bullish continuation pattern: the top line is flat (resistance), and the bottom line slopes upward (higher lows).

- Approx. Success Rate: 65–75%

- Notes: Often breaks out upward, but if it fails, that can be a strong bearish signal.

Descending Triangle

- Overview: Often a bearish continuation pattern: the bottom line is flat (support), and the top line slopes downward (lower highs).

- Approx. Success Rate: 60–70%

- Notes: In strongly bullish markets, the pattern may actually break upward more than you’d expect, so context matters.

Symmetrical Triangle

- Overview: Converging trendlines of lower highs and higher lows, can break either way. Often seen as a continuation pattern of the prevailing trend.

- Approx. Success Rate: 55–65%

- Notes: Because they’re more neutral, success rates vary widely with market sentiment. The direction of the breakout is key.

4. Cup & Handle

- Overview: A bullish continuation pattern where price forms a rounded “cup,” then a slight pullback (the “handle”) before breaking out.

- Approx. Success Rate: 65–75%

- Notes: Typically seen in stocks and crypto after a strong uptrend. The handle should ideally be shallower than the cup.

5. Wedges (Rising/Falling)

Rising Wedge (Bearish)

- Overview: Price makes higher highs and higher lows, but the slopes converge. Typically signals a bearish reversal when price breaks down.

- Approx. Success Rate: 60–70%

Falling Wedge (Bullish)

- Overview: Price makes lower lows and lower highs, converging. Typically signals a bullish reversal when price breaks up.

- Approx. Success Rate: 65–75%

6. Flags & Pennants

- Overview: Short-term continuation patterns that form after a sharp price move (the “flagpole”). The price consolidates in a small rectangular (flag) or triangular (pennant) shape.

- Approx. Success Rate: 60–70%

These patterns often appear in strong, trending markets—crypto in particular. Volume spikes during the initial move and tapers off during consolidation.

Important Disclaimers

- Market Conditions Matter: A descending triangle in a strong bull market might break upward more often than historical averages suggest, and vice versa.

- Success Rate Definitions Vary: Some studies count success as “price hitting the measured target,” while others might require just a breakout in the expected direction.

- Risk Management Is Crucial: Even if a pattern has a high historical success rate, no pattern is 100%. Use stop-losses or other risk controls.

- Combine with Other Analysis: Consider volume trends, support/resistance levels, and overall market sentiment. Patterns alone shouldn’t be your only tool.

In Summary

Chart patterns like triangles, head & shoulders, and double tops/bottoms can offer useful clues about potential price direction. Historical success rates (60–80%) suggest that many patterns can be profitable if traded properly. However, always incorporate solid risk management and remember that no chart pattern is guaranteed in every scenario.

:max_bytes(150000):strip_icc()/GettyImages-1737798678-34b3ce47535d42ff81a63ac6677b8e39.jpg?w=150&resize=150,150&ssl=1)