Now Reading: 9.6% yield! Here’s the dividend forecast for Glencore shares to 2027!

-

01

9.6% yield! Here’s the dividend forecast for Glencore shares to 2027!

9.6% yield! Here’s the dividend forecast for Glencore shares to 2027!

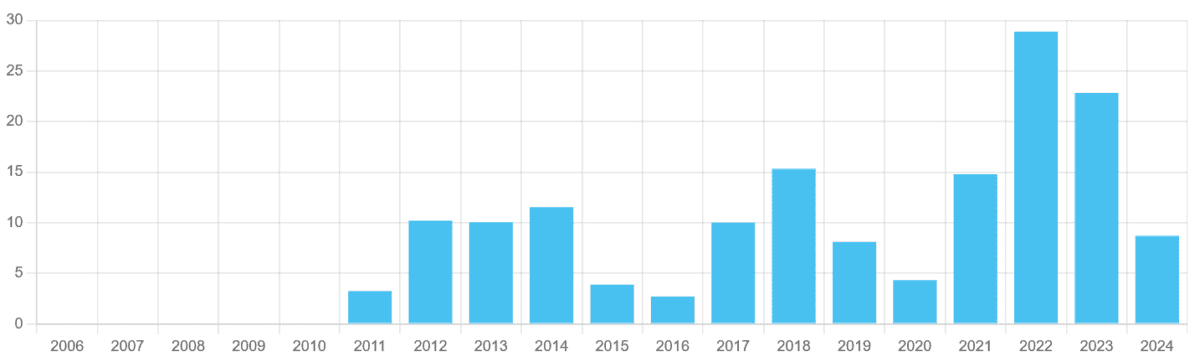

Mining stocks are among the most cyclical out there. Annual profits can swing wildly depending on economic conditions, as can shareholder dividends. This has been the case with Glencore (LSE:GLEN) shares for more than a decade.

Since listing on the London Stock Exchange in 2011, shareholder payouts have been up and down like a see-saw. More recently, they’ve sank as China’s spluttering economy and higher global interest rates hit commodities demand. In the years before that, they rose strongly as a post-pandemic recovery drove metals and energy values.

Encouragingly, however, City analysts are tipping Glencore shares to rebound strongly over the next few years.

9.6% dividend yield

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 14 US cents | 40% | 3.8% |

| 2026 | 22 US cents | 57% | 6.2% |

| 2027 | 34 US cents | 55% | 9.6% |

You’ll perhaps be unsurprised that this stunning expected dividend growth coincides with expectations that profits will bounce back signficantly.

Currently, the number crunchers expect Glencore:

- To swing from losses per share of 13 US cents last year to earnings of 20 cents in 2025.

- To record earnings of 33 US cents in 2026, up 65% year on year.

- To print earnings of 44 US cents the following year, a 33% increase.

Such growth far outstrips expected dividend growth of 1.5%-2% for the broader FTSE 100 over the near term. It also means dividend yields on Glencore shares shoot past the FTSE’s long-term average of between 3% and 4%.

Shaky cover

But dividends are never guaranteed, of course. So I need to consider how realistic these forecasts are.

On the plus side, Glencore’s robust balance sheet may leave it in better shape to pay dividends during a fresh downturn than many other miners. As of December 2024, its net-debt-to-EBITDA (earnings before interest, tax, depreciation, and amortisation) ratio was a modest 0.78.

But as we’ve seen time and again, this probably won’t be enough to stop cash rewards collapsing if profits sink. Glencore already looks exposed on this front, with predicted dividends covered between 1.3 times and 1.5 times by expected earnings through to 2027.

These figures sit far below the security benchmark of two times.

Should investors buy Glencore shares?

On balance, then, predicting the size of Glencore’s dividends to 2027 remains a tough ask given current macroeconomic uncertainty.

Encouragingly, the US-China trade deal announced today (12 May) bodes well for the company’s profits, as does a steady fall in worldwide inflation. However, substantial risks remain to the global economy (and by extension) to commodity prices, including the potential for fresh dust-ups between the US and other major trading partners.

It’s helpful, therefore, to consider the returns Glencore shares may deliver over the longer term rather than just the next few years. And from this perspective, I’m far more upbeat when it comes to assessing the company’s dividend and share price potential.

As both commodities producer and trader, the FTSE firm has significant opportunities to exploit the next ‘commodities supercycle’. I think earnings and dividends could soar as themes like the growing digital economy, rapid urbanisation, and decarbonisation initiatives drive metals demand.

I buy shares based on their investment potential over at least a decade. And on this timescale, I think Glencore’s are worth serious consideration.

The post 9.6% yield! Here’s the dividend forecast for Glencore shares to 2027! appeared first on The Motley Fool UK.

Should you invest £1,000 in Glencore Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Glencore Plc made the list?

More reading

- Are Glencore shares a bargain after falling 33%?

- A £10,000 investment in Glencore shares 10 years ago is now worthâ¦

- £10,000 invested in Glencore shares 5 years ago is now worth…

- 3 beaten-down UK shares to consider in an ISA before markets recover

- 5 lessons from the latest stock-market crash

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

![What brands need to know [data] What brands need to know [data]](https://i2.wp.com/www.hubspot.com/hubfs/x%20vs%20threads.png?w=1024&resize=1024,1024&ssl=1)

:max_bytes(150000):strip_icc()/GettyImages-2167943647-526bc314c35d4bf6bfc62e5086467c02.jpg?w=1920&resize=1920,1267&ssl=1)

:max_bytes(150000):strip_icc()/NKEChart-76e8264193ef4eeea262abf50f5737d9.gif?w=150&resize=150,150&ssl=1)

![What brands need to know [data] What brands need to know [data]](https://i2.wp.com/www.hubspot.com/hubfs/x%20vs%20threads.png?w=150&resize=150,150&ssl=1)